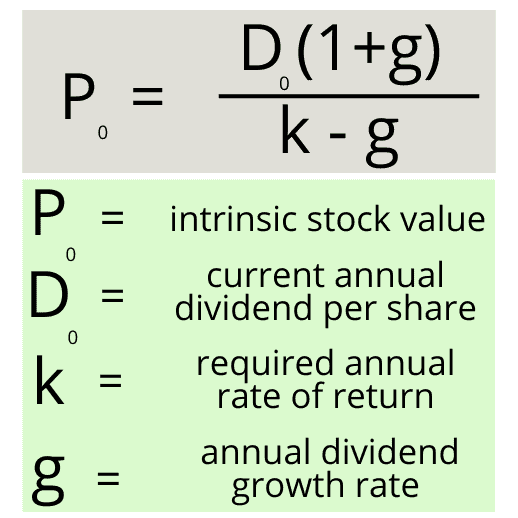

More h model growth formula images. The gordon growth model (ggm) is used to determine the intrinsic value of a stock based on a future series of dividends that grow at a .

Feb 25, 2020 can someone explain what the second part of the h model means? so if they have a high growth rate of 10 that is going to decline to 5 . The h model of valuing growth is used by investors to value companies or shares of a company with 2 distinctive stages of growth. it is a form of dividend discount valuation, belonging to the set of models called the gordon growth models. 16cd dividend discount models (h-model) · because a country's expected growth rate is a good estimate of earnings and dividend growth rates for domestic firms. The gordon growth model formula can be used to calculate the present value of h model growth formula all future dividends based on this stable 7% increase per year. discount models and the time value of money like the two-stage, three-stage, and gordon growth models, the h-model is a valuation formula that discounts future cash flows using an expected rate of return.

Hmodel For Valuing Growth Finance Train

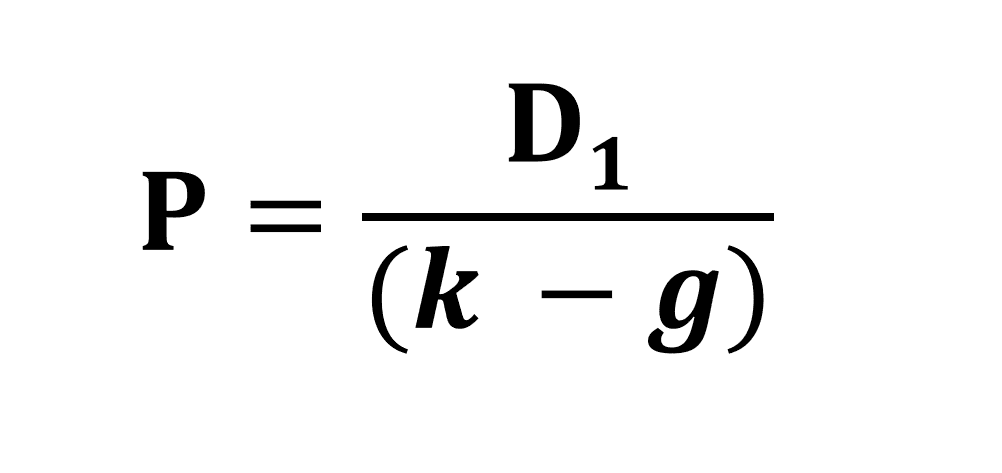

Use the h-model dividend discount model calculator to compute the intrinsic value of a stock. look up a stock's current annual dividend and historical dividends at yahoo! finance or another stock site. use the dividend growth rate calculator to get a stocks's annualized dividend growth rate. note: the high growth stage and stable stage cost of. Like the content? support this channel h model growth formula by buying me a coffee at www. buymeacoffee. com/riskmaestrocfa level 2topic: equity . H model on paper gordon growth model financial markets by yale university 22. coursera hybrid model (calculation of h-parameters). The h-model formula. the h-model formula can be broken down into two parts which are then added together: 1) the gordon growth model (ggm): this is a single-phase, terminal growth calculation which forms the core base of the h-model valuation. it takes the previous year’s dividend brought forward by the long-term growth rate and then divides.

The h-model is a quantitative method of valuing a company's stock price. · it is similar to the two-stage dividend discount model, but differs by attempting to . H model is another form of dividend discount model under discounted cash flow (dcf) method which breaks down the cash flows (dividends) into two phases or stages. it is similar or one can say a variation of a two-stage model however unlike the classical twostage model, this model differs in how the growth rates are defined in the two stages. The model is a variation to the standard dividend growth model proposed by myron j. gordon. the model can be used to model a linearly declining growth rate. on this page, we discuss the h-model in more detail, provide the h-model formula and finally implement the h-model using an excel spreadsheet. The three-stage dividend discount model is much like its simpler counterparts, the gordon growth model, the two-stage model, and the h-model. in fact, it is essentially a combination of these three models that aims to eliminate some of the shortcomings intrinsic to those formulas.

Discounted Cash Flow Analysis Example Of The Hmodel Youtube

The growth model of coaching is my enhancement of the time-tested grow model of coaching. i modify the four elements of the h model growth formula grow model and add two additional steps to create the growth model. t = team capabilities. h = how-to-manage. big goals and problems cannot be achieved or solved alone. H-model for valuing growth. the h-model is a modification of the two stage ddm. unlike other two-stage models where the growth rate is assumed to be a constant, the h-model assumes that the growth starts at a higher rate, and then gradually declines till it becomes normal stable growth rate. “h” represents half-life of the high growth period.

Jun 14, 2021 gordon growth model used for terminal value calculation in dcf. example: realest company h. determine the equity value. What is the gordon growth model? how is it different from the dividend growth model? discover the most straightforward financial definition anywhere.

Feb 25, 2020 behind the valuation formula for the h-model, or its derivation? growth in normal years and the second is the additional growth in . Jan 22, 2017 look at the formula here. the denominator is the same. you've already calculated for constant growth, now you add the extra growth taken as ( .

The h-model is a quantitative method of valuing a company’s stock price. it is similar to the two-stage dividend discount model, but differs by attempting to smooth out the high growth rate period over time. the h-model formula h model growth formula is rendered as: d 0 (1+g 2) + d 0 *h*(g 1-g 2/(r-g 2). Notice that the formula is quite similar to the gordon growth model formula ; the second component i. e. $145. 33 is the addition in value resulting from the high growth period for 5 years. this component is where the h model differs from other dividend discount models ; accuracy of the model:.

0 Response to "H Model Growth Formula"

Posting Komentar